The tractor market in the first quarter of 2025 continues to decline, but in a less worrying way than in the past. It is likely that sales are moving towards balances that are hopefully no longer conditioned by external factors

Furio Oldani

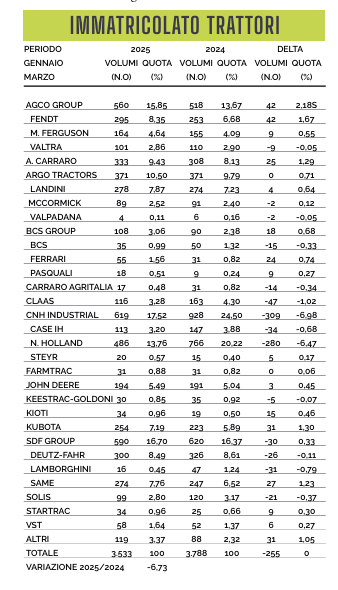

Registrations of agricultural tractors in the first three months of 2025 show a decline of around six percent compared to the same period in 2024, a year that, due to the accumulation of several negative factors, will be remembered by the sector as one of its most challenging historical periods.

The current downturn, therefore, does nothing more than prolong a difficult situation for which, however, there now appears to be light at the end of the tunnel. In fact, it is a commonly held belief among industry professionals that sales should begin to return to more satisfactory levels by mid-2025.

Especially for those manufacturers able to offer machines that are aligned in both features and price with the expectations of farming businesses.

The fact that, compared to 17,000 new tractors sold in 2023, there were 52,800 used ones sold — according to data from FederUnacoma — indicates that the current offering of new machines is not fully in line with the investment capabilities of many agricultural enterprises, and perhaps not even with their technological needs.

This issue especially affects small to medium-sized and family-run farms, which, operating on smaller plots, are often unable — and in some cases unaware of how — to fully exploit the benefits offered by the digitalization of machinery and equipment. Further confirmation of this is provided by the over seven percent of registrations accounted for by compact Asian tractors. Essential but functional machines that honestly get the job done.

They are available at affordable prices thanks to the low production costs in their countries of origin, and often also due to local state subsidies. These two factors — as has been pointed out in the past — should ideally be curbed through specific taxation measures. Donald Trump would agree.

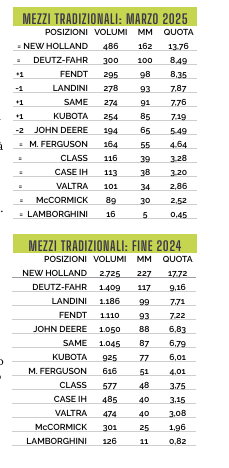

Looking at the registration data more closely, it’s clear that figures are stable or growing for almost all brands, with the exception of New Holland. New Holland, infact,, having sold 280 fewer machines, heavily contributes to the overall market decline.

Title: Tractor market first three months 2025: light in the tunnel

Author: Furio Oldani

Translation with ChatGPT