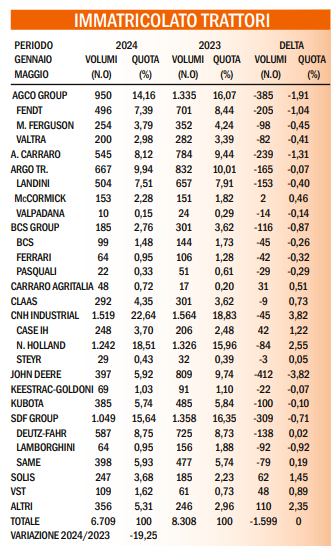

The first five months of 2024 saw tractor registrations drop from around 8,300 units in 2023 to about 6,700, a decline of over 19 percent.

On paper, this is a significant recovery compared to the roughly 25 percent drop recorded at the end of March, but the reality behind the numbers is quite different and aligns with the predictions previously made by Cema, the European association of the sector’s manufacturers. In May, CEMA indeed proposed slightly rising economic climate indices, suggesting the end of the recessionary period that began 14 months earlier.

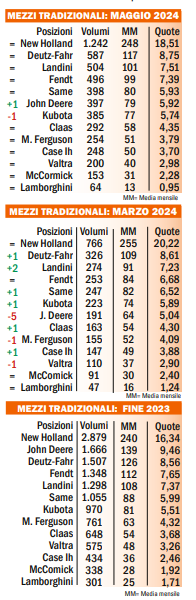

However, at the beginning of June, the same organization had to retract its own statements. New data did not confirm the previous positive trend, suggesting that the recession may not have hit bottom yet. Confirming this are the national data for the rolling year May 2023-May 2024, which, if verified, would bring the 2024 market to close with a volume just under 16,000 units, the worst volume of the new millennium and also lower than the average of about 18,500 units/year that have characterized registrations from 2013 to the present, with exceptions in 2017, the year when the current European regulations came into force forcing manufacturers to register non-compliant tractors still in stock, and the years 2021 and 2022 when the market was inflated by decidedly generous government subsidies.

These same subsidies can be blamed for the current crisis, which will likely persist until the end of 2024, when the leases contracted in 2021 are expected to begin expiring. For a few more months, manufacturers will have to grit their teeth, accepting the idea that “it can’t rain forever,” and when the sun returns, those who have invested in themselves in terms of innovation and promotion will be the first to reap the benefits. The table shows data related to the most important players in the Italian market and, for each, the trend compared to the first five months of 2023. In terms of volumes, John Deere suffers more than others, losing over 410 units, but Fendt also declines significantly with about 240 units.

Landini drops about 150 units, Deutz-Fahr around 140, while Kubota, Lamborghini, Massey Ferguson, Same, and Valtra are down between 80 and 100 units. In stark contrast, thanks to their decidedly competitive price/performance ratios, are the Asian brands Solis and VST, as well as Case IH, which registered 42 more tractors than in the first five months of the previous year. McCormick, Claas, and Steyr remain stable. Among the specialized manufacturers, notable is the sharp decline of Antonio Carraro with almost 240 units, the decline of the three brands under the BCS group with about 115 tractors, and the contraction of Keestrack-Goldoni, a brand that recently assumed the role of importer for the Asian tractors Tym.

Title: The deep red of the market

Author: Furio Oldani

Translation with ChatGPT