Different trends were experienced by brands in the Old Continent last year. In the face of a negative trend, in some cases even heavy, which affected the commercial results of almost all the protagonists of European agricultural mechanization, a few but significant performances counter-trended.

Filmed in 1994, “The Crow” is a cult film for noir lovers. However, it is also known outside of that circle for the phrase with which the protagonist, Eric Driver, aka Brandon Lee, tries to comfort his friend Sarah, who is threatened by a gang of thugs. “It can’t rain all the time,” Eric tells Sarah, a statement that tractor manufacturers should embrace more than ever in these times, still struggling with the sales crisis that began in 2023, continued in 2024 and is feared to continue for a good part of 2025. This is in light of the economic uncertainties caused by ongoing conflicts and the reckless economic positions proposed by American President Donald Trump. A fear also confirmed at the end of February by the “Business Barometer” survey published by Cema, the European association of agricultural machinery manufacturers.

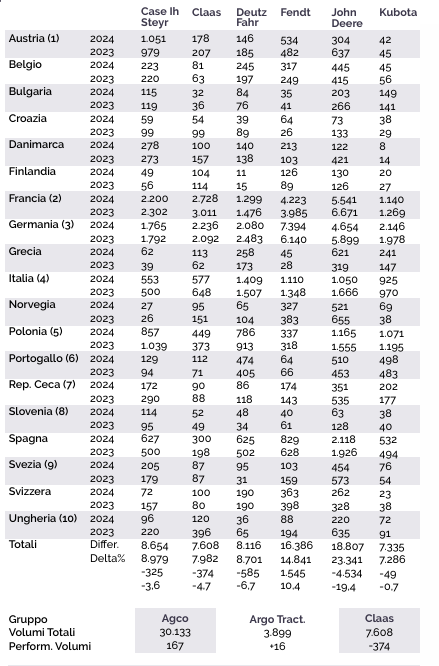

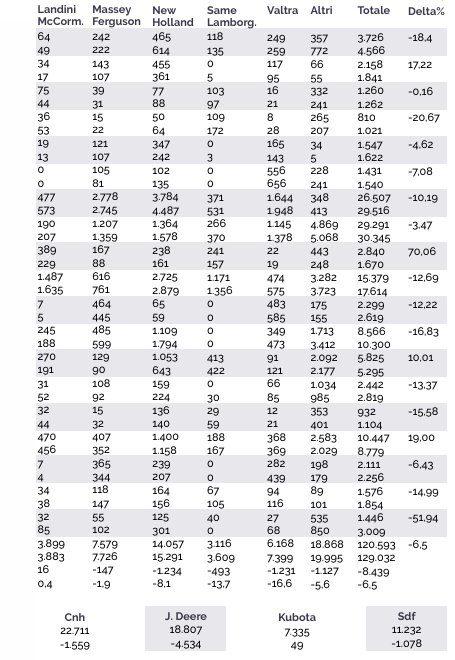

It photographs a sector that is still disheartened by sales trends, but to a lesser extent than in the past, a statement that is questionable, however, as the survey is based on findings made long before Trump’s outbursts. The same ones to which international stock markets responded with a sharp and widespread decline. The future is therefore in doubt like never before, a reality that forces manufacturers to work day by day rather than on the basis of medium-term planning. A situation that is also conditioned by the increase in production costs and high interest rates that make access to credit difficult. Factors that, together with the stagnation of agricultural incomes, have affected the demand for machinery in all the main European countries. As can be seen in the table on the side, almost all markets in Europe are slowing down, with declines that exceed twenty percent.

European tractor registrations 2024: fluctuating trends

A trend that does not spare the largest consumers of tractors with the sole exception of Spain, which however has suffered in recent years. The Spanish data could therefore be a precursor to a recovery that could mature towards the end of this year or during 2026, when three-year leases expire and agricultural companies will have to think about the alternative of keeping machines that in the meantime will have accrued more than four or even five thousand hours of work or changing them by opening new leases. It follows that if unforeseeable events do not arise, the tractor market is destined to recover in the short term. As EricDriver said, “it can’t rain all the time”. A clarification. The table does not include data from Lithuania, the Netherlands and Serbia, countries that in 2023 had a total of approximately six thousand and 230 machines. England is also absent, having registered approximately 13 thousand and 340 registrations in 2023.

European registrations 2024 tractors: the tables

Case Ih and Steyr

The decline of the Austrian-American duo that belongs to the Cnh Industrial group was contained. In the face of a seven and a half percent decline in the European market, the two brands recorded a decline of just under four percent, leaving 348 machines on the ground compared to 2023. It is interesting to note that most of the losses derive from the declines incurred in Poland and the Czech Republic, while in the two main European markets, Germany and France, Case Ih and Steyr are practically stable on an annual basis, even showing growth in Italy and Spain. This latter indication of how the product line of the two brands is perceived by the market as technologically advanced and therefore rewarded where agricultural entrepreneurs have greater spending availability for their machine fleets.

Claas

425 fewer tractors registered by the German manufacturer in 2024, for a percentage drop of five points and four. Less than the general market and therefore a result that is far from despicable, especially in light of the fact that by tradition and vocation the Harsewinkel brand is very oriented towards the medium-high and high-end range, two segments particularly penalized by a European market that last year saw medium and low-power machines dominate. Confirmation of this is the growth achieved in Germany, despite a local market in recession, and the positive commercial results obtained in ambitious markets in terms of quality such as the Polish and Spanish ones, probably benefiting in this perspective from the appreciation enjoyed by users who already have self-propelled harvesting machines of the German brand in their fleet.

Deutz-Fahr

The premium brand with the greatest international vocation of the Sdf group has closely followed the trend of the continental market. The decline on an annual basis is in fact only four decimal points higher than the European average decline of seven and a half percent and has given rise to a reduction in volumes in the order of 670 machines. Losses almost entirely attributable to the three main European markets, Germany, France and Italy, in which the brand has lost, respectively, 403, 177 and 98 machines compared to 2023. The growth achieved in Spain has done little to help, offset by modest declines in almost all the remaining markets, confirming the difficult moment experienced last year by the brand and more generally by the Sdf group.

Fendt

The only one to close 2024 with growth, the Marktoberdorf-based company even achieved an increase of ten and three percent, gaining over one thousand and 500 registrations compared to 2023. An exploit mainly due to the brilliant performance achieved in Germany, its traditional reference market, where the technological brand of the Agco group saw volumes grow in the order of one thousand 250 machines, thus becoming the market leader with over two thousand and 500 units of detachment on John Deere, second in the ranking. Few markets in which Fendt registrations suffered a decline, limited to those that, like Italy, paid the price for the end of the tax contributions implemented by the various governments or those in which the high and very high power segments were most penalized.

John Deere

The US multinational is the one that paid the highest price both in percentage terms and in terms of volumes. Over four thousand and 800 fewer tractors registered in the Old Continent in 2024, which gave rise to a 21 percent decline on an annual basis. It is impossible to think that the historic world leader in the sector has suddenly seen European users turn their backs on it. It is much more likely that the House of the Deer was the victim of a dual trend last year. With on the one hand the markets saturated in the last three years by growth supported by the presence of tax contributions that have suffered an inevitable backlash and on the other hand the update of the offer in the medium and medium-high powers carried out by John Deere last year which induced users to wait for the actual arrival on the market of the new models to plan the purchase. If this was really the case, the signs should be visible already this year.

Kubota

Kubota’s 2024 was almost stable. The Osaka Group in fact closed with a decline limited to zero and four and four percent which translated in terms of volumes into 45 fewer machines registered. Fendt aside, the best European performance, to which the growth recorded on a leading market such as the German one contributed decisively, which was also conditioned last year by a decreasing trend. The recent expansion of the offer in the medium and low power ranges probably contributed a lot to achieving this result, thanks in the latter case to the integration in the Kubota range of machines developed jointly with Escort Limited, an Indian company of which the Japanese multinational is a reference shareholder, which should have helped the brand to resist strong Asian competition in this market segment.

Landini and McCormick

The difficulties experienced last year by the Italian agricultural mechanization sector did not have an impact on the brands that belong to Argo Tractors. Landini and McCormick saw continental registrations for 2024 grow by 0.4 percent on an annual basis, a value that translated into volumes is in the order of 16 machines. The aforementioned saturation of the Italian market and the decline in the French specialist market were however offset by the good performances of Landini and McCormick in Greece, Poland, Portugal and Spain, a sign that where there are no structural market difficulties, the reliability and quality of “Made in Fabbrico” tractors always achieve deserved commercial success.

Massey Ferguson

In a hypothetical ranking of the best trends for 2024, Massey Ferguson would be on the third step of a virtual podium behind Fendt and Kubota. Not that the brand that belongs to the Agco group has anything to celebrate, but the percentage decline limited to three points and having left “only” 226 machines on the ground is a result that is far from despicable. The slight growth achieved in France is decisive in this regard, in the face of a market that has fallen by more than ten percent and probably thanks to being perceived as a home brand thanks to its historical roots in Beauvais, and the limited increases recorded in the Nordic markets, Denmark, Finland, Norway and Sweden. However, these performances were counterbalanced by the significant declines suffered in Germany, Italy and Poland, which alone accounted for 411 fewer tractors registered and which in practice took away from Massey Ferguson the possibility of being the second brand to close 2024 in the green.

New Holland

Slightly higher than the market trend, one point and two decimal points, the decline recorded by the Brand that belongs to Cnh Industrial. The more than one thousand 300 fewer machines registered last year, which, translated into percentage terms, are worth eight points and seven tenths, are largely the result of a generalized decline that, although without particular peaks, saw New Holland lose second place in France to Fendt and the leadership in Poland, passed by a handful of tractors to John Deere. Confirmed instead the second place in Spain, behind John Deere, and the primacy in Portugal, two markets that however in 2024 were in strong contrast to the continental trend and therefore in this sense not very significant for understanding the commercial evolution that New Holland is experiencing in function of the renewal and restructuring process implemented last year by Cnh Industrial.

Same and Lamborghini

Negative, in the order of 16 and 7 percent on an annual basis, the performance of the two Italian brands of the Sdf group, Same and Lamborghini. And it could not have been otherwise given the choices of the Bergamo-based multinational to progressively impoverish the Same tradition to the advantage of Deutz-Fahr and to “kill” the Lamborghini brand to transform it into a special setup for Deutz-Fahr customers. In the first case, Same has inevitably suffered from Asian competition in the medium-low and low-power segments, paying the price even in those developed markets, such as France and Germany, which have always recognized the technical maturity of the Treviglio brand, while in the second Lamborghini has become an exclusively aesthetic alternative that it is not clear what and how much appeal it can have on customers who orient themselves towards the Deutz-Fahr offer for its technical content and not for the livery and logos. Perhaps enriching instead of impoverishing two historical Italian excellences would have better supported the commercial ambitions of the Lombardy Group.

Valtra

After years of constant and progressive growth, Valtra’s run comes to a halt. Having almost completely eliminated the gap with Massey Ferguson in 2023, the Finnish brand of the Agco group suffered a heavy setback in 2024, falling by 16.7 percent and leaving over a thousand and 200 registrations on the ground. T

he decline also involves those Nordic markets, Finland, Norway and Sweden, where Valtra has always been among the market leaders and therefore it is difficult to assume that the trend experienced by the Finnish company can be attributed to a generalized and contemporary commercial shift towards other brands. More plausible is that the traditional focus of the Valtra product line towards the top of the range has been significantly affected by a European market that last year showed signs of holding up in the medium and low power segments, but which instead recorded significant drops in the medium-high and high power segments.

Title: European tractor registrations 2024: fluctuating trends