Furio Oldani

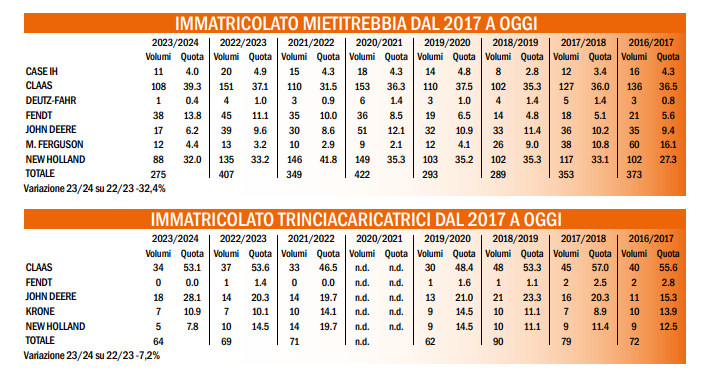

Tough times for large self-propelled harvesters, particularly combine harvesters. The surge in registrations driven by government incentives introduced to address the economic challenges of Covid19 has come to an end with the depletion of available funds, giving way to a sharp decline. According to FederUnacoma sources, the market has dropped from 407 machines sold in the previous season to 275, a figure also confirmed by investigations conducted by industry publications.

This sector’s crisis is tangible and likely not solely tied to the cessation of financial aid. Analyzing registration data from the 2016/2017 season to the present reveals a vaguely sinusoidal trend, with two seasons of rising registrations followed by two seasons of decline. However, the upward trend between 2020 and 2023 was amplified by government incentives, which enabled medium-sized companies to make otherwise unaffordable investments and allowed larger, more structured companies to significantly update their fleets.

Given that combine harvesters are not replaced at the same frequency as tractors, and their registration volumes are not comparable, it was inevitable that sales—and consequently registrations—would eventually experience a steep downturn. This trend has affected all players in the sector, albeit to varying extents. The two historical rivals and market leaders, Claas and New Holland, have seen the largest reduction in machine volumes. However, U.S. brands Case IH and John Deere are also struggling, with their registrations halving or nearly halving.

Unsurprisingly, both have launched new models during 2024. Fendt has experienced a more modest decline, Massey Ferguson remains stable, and Deutz-Fahr appears to be phasing out of the sector. The Italian-German brand’s harvesters have never gained significant traction in Italy, prompting the SDF Group to recently shut down its Croatian factory where these machines were built.

The self-propelled forage harvester market has also seen a decline, albeit less severe than that of combine harvesters. For several years, registrations for these machines fluctuated between 70 and 80 units, peaking at 90 during the 2018/2019 season before dropping to 62 the following season — an average of 76, consistent with previous trends. However, this volume has declined further in the 2021/2022 and 2022/2023 seasons, stabilizing around 70 machines, only to decrease again last season.

As always, it is worth noting that these figures are based on journalistic investigations, as manufacturers are not able to disclose their registration volumes directly.

Title: Combine harvester and forage harvester market 2023/2024 season, return to the past

Translation with ChatGPT